Keeping Cash Transactions in Australia

The Keeping Cash Transactions in Australia Bill 2024 is about ensuring that cash stays a reliable option for Aussies, especially our seniors, who depend on it.

To follow the progress of this important legislation, head to the bill's page on the Parliament website.

What is the Bill?

The Keeping Cash Transactions in Australia Bill 2024 aims to preserve the freedom for Australians to choose how they will pay for transactions.

It’s a response to concerns from many in our community who fear that cash is being phased out by banks and institutions, and that it may soon disappear.

The bill mandates that businesses providing goods and services in face-to-face settings, within a premises, structure or vehicle at which a person carries on a business, must offer to accept, and must accept, payment in cash if the transaction does not exceed $10,000.

It provides for maximum civil penalties of $5,000 for a person and $25,000 for a body corporate if its requirements are contravened.

It also permits reasonable exemptions, such as:

When accepting cash for a transaction poses a security risk;

If it may be contrary to another law of the Commonwealth or a law of a state or territory;

When it would go against Commonwealth or state/territory health advice;

When cash in the form of smaller change is needed but not readily available.

This bill is not about imposing burdensome regulations on businesses but about striking a balance between innovation and inclusivity.

It's about preserving the essence of choice in our financial transactions.

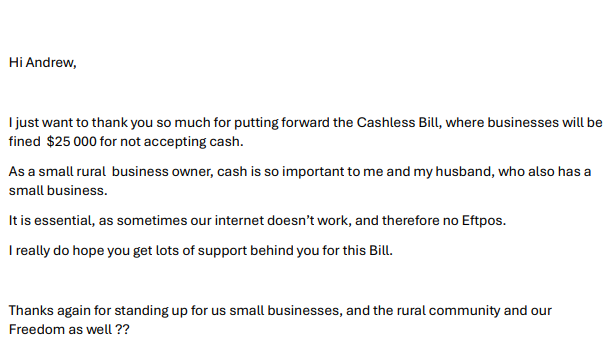

Since introducing my Keeping Cash Transactions Bill 2024 to the Australian Parliament I’ve been inundated with calls, emails, and hand-written letters from across the country, all expressing a clear message:

We want to keep cash!

Key Outcomes of the Bill

Supporting Seniors

The RBA found that Australians over 65 are the heaviest users of cash. For many older Australians, cash is more than just a convenience—it's a lifeline. Many seniors prefer not to use cards for their transactions and find online banking services stressful and confusing. And in times of economic uncertainty and rising costs, for many seniors, cash is a vital tool for managing finances and their household budget.

Addressing Merchant Fees

Paying with cards often means additional fees. Banks and financial institutions frequently charge merchant fees for card transactions, costs that are often passed on to consumers. Australians lose an estimated $1 billion annually to card surcharges.

Cash is Dependable

In regional and rural areas, reliable internet access is often lacking. Cash is a dependable means of exchange that does not rely on electricity or internet connectivity making cash particularly valuable in remote areas where technological infrastructure is limited or unreliable.

Protecting Against Digital Failures

Cash transactions remain unaffected by digital failures. During natural disasters like fires or floods, access to digital payments can be disrupted for extended periods, making cashless payments impossible.

Supporting Budgeting Practices

Many Australians prefer using cash for managing their budgets. It helps them keep track of spending and avoid overspending. Using cash makes financial management more tangible and straightforward for many individuals.

Reducing Fraud Risks

For many, there are concerns about fraud and security risks associated with card use. Many Australians have experienced fraud and unauthorised transactions with cards and linked accounts. Cash transactions reduce the risk of such digital fraud, providing a safer option for many.

Preserving Privacy

Some Australians choose cash over cards to maintain privacy, preferring not to have corporations track their every purchase. This choice should be respected, to allow individuals greater control over their personal data and spending habits.

Promoting Financial Literacy

The decline of cash transactions can impact children's financial literacy. Using cash can help teach valuable lessons about budgeting, making choices, and understanding the true value of money. How can our kids learn about money if they don’t know what it is? Physical money transactions can provide more concrete learning experiences for young people.

Supporting Immigration and Tourism

Cash is vital for tourism and immigration as it enables immediate and accessible transactions, especially in areas with limited digital payment options. Tourists rely on cash for small purchases and tips, while immigrants use it to cover essential expenses during their initial settlement period.

Current Law

My bill fills a void in our laws regarding financial transactions.

Did you know that while notes and coins are legal tender, businesses are under no obligation to accept cash? All a business has to do is tell a customer before the transaction takes place that cash will not be accepted. The acceptance of cash is currently at the sole discretion of the business.

The Keeping Cash Transactions in Australia Bill is all about freedom—the freedom for Australians to choose how they will pay for transactions.

It's not a choice that should be made for them by financial institutions or businesses.

How to Show Support

We need your help to pressure the government to support my Bill and Keep Cash King in Australia!

Let your voice be heard about this issue by emailing the Treasurer: jim.chalmers@treasury.gov.au

Or post a letter to: PO Box 6022 Parliament House CANBERRA ACT 2600